Equity markets have had a choppy November, with both US and Australian shares off sharply from their October highs.

Risks remain elevated, particularly in the world’s largest economy, the US. Valuations are stretched, AI exuberance is a concern, rate-cut expectations are uncertain, Trump’s tariffs may have lagged effects, public debt is high, and the labour market continues to weaken.

Should investors be worried by a slowing US economy?

US consumer confidence weakened again in October, marking a third consecutive monthly decline as worries grow over a slowing economy and a softening labour market. The Consumer Confidence index [1] dropped to its lowest level since wide ranging tariffs were first announced in April.

Confidence remains below last year’s levels as Americans fret about job security and rising living costs. Job growth has slowed noticeably, and inflation has climbed to 3%.

Meanwhile, uncertainty is being amplified by President Trump’s trade war, unpredictable tariff announcements and concerns that many of those measures may yet prove unlawful.

This risk averse backdrop dominated investor sentiment over November.

Investors have been uneasy about the “overvalued” tech sector and signs of softer earnings growth, a December Fed rate cut looks less clear cut and the recent lack of US data following the government shutdown has created a “fog” for the central bank, making it harder to manage monetary policy.

As the chart below shows some of the most speculative assets – the tech sector, crypto currencies and even gold – all came off their highs in November.

As we start the last month of the year, gold and the Nasdaq index have stabilized and are moving higher. Bitcoin, on the other hand, continues to track lower, and is now returning -2.3% year to date.

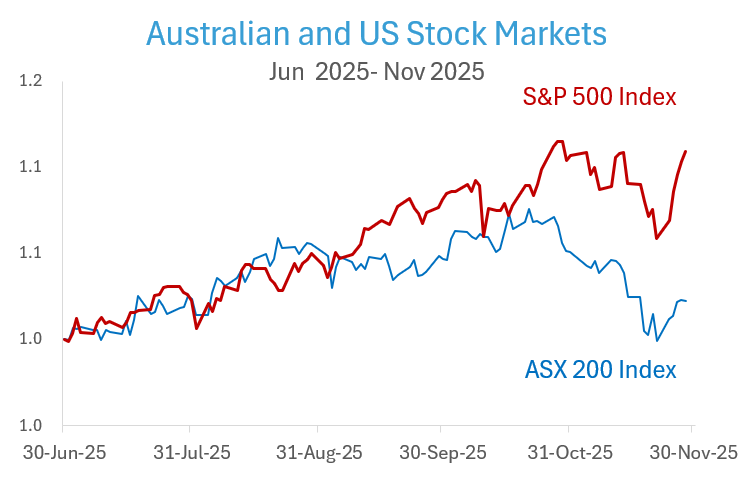

The Australian market is often seen by global investors as a risk market as well, and as the chart below shows that the Australian market fell by more than the US market over the month of November.

This is because the Australian market was not only caught up in the general global sell-off but also had to contend with a higher than expected September quarterly inflation print.

Persistent inflation has meant that a December rate cut in Australia is now off the table, and money markets are now trading with a view that there won’t be another rate cut this cycle.

In fact, markets are predicting that the next move for the RBA will not be until the middle of 2026, and that move is more likely to be an interest rate rise rather than a cut.

On the other hand, the US Federal Reserve is expected to cut interest rates by 25 basis points at their December meeting, with additional reductions likely at the following two meetings.

But, inflation has risen to 3%, and Fed officials are warning that an additional rate cut in December could be harmful.

While policymakers generally agree the labour market has cooled, they also caution that further cuts could jeopardize years of progress in keeping price pressures under control.

As we head into the final weeks of 2025, there is no doubt that markets are seeing a darkening in the skies. Most analysts and economists agree that risks remain elevated: valuations are stretched, enthusiasm around AI is still excessive, and expectations for rate cuts in the US are uncertain.

Against this though, global profit growth remains strong and there is no sign of recession suggesting that the broad trend in shares may remain up.

Shares have had several years of strong gains, with the last bear market in global shares being in 2022. Over the last 3 years US shares have returned 23%pa, global shares 21%pa and Australian shares 13%pa.

History warns that after a run of strong above average years a weaker year and often a bear market can come along.

As we have said many times, the economy is not the share market.

For investors, the danger in trying to time corrections and bear markets is that you miss out on longer-term gains. The key is to adopt an appropriate long-term investment strategy and stick to it.

[1] The Consumer Confidence Index (CCI) is a key U.S. economic indicator compiled by The Conference Board, a non-profit research organization providing economic, business, and management insights.

This article was written by Dr Steve Garth - Principal of Principia Investment Consultants.

Leave a Comment